1. Purpose

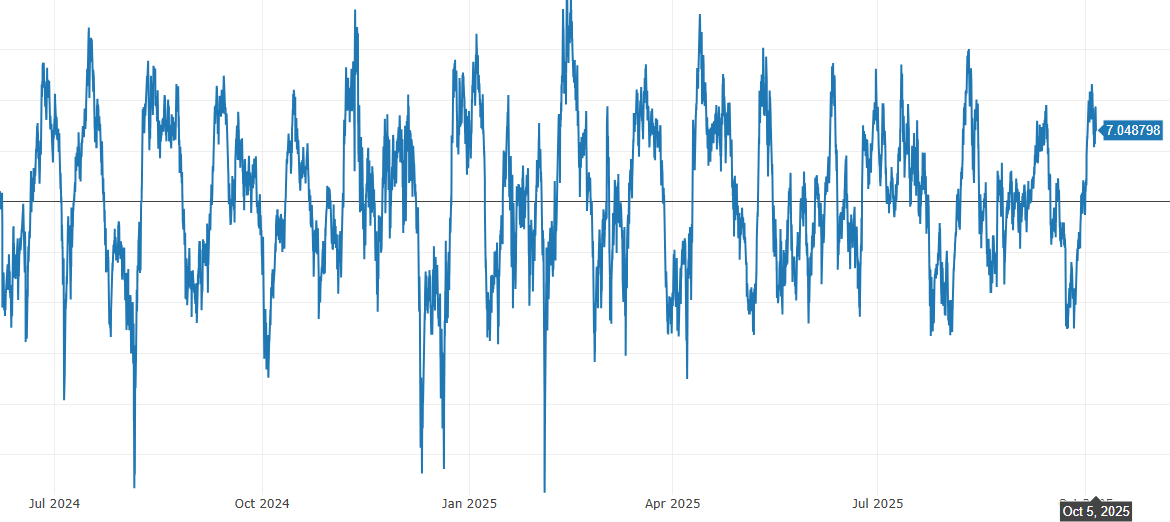

A consolidated “temperature” metric for the altcoin market on the 30-minute timeframe. Shows where, on average, altcoin prices sit relative to the midlines of their regression channels over the most recent history window.

2. Definition

For each asset, a regression channel is built over the last 1000 candles on 30m. The current price’s position relative to the channel midline is taken and expressed in percent. The median of these values across all alts is then computed. The resulting number is the current value of the 30m indicator.

3. Regression channel

- Midline — a smoothed line describing the primary direction of price over time.

- Bounds — two parallel lines around the midline showing the typical price “spread.”

- Types:

- Bullish — midline slopes upward.

- Bearish — midline slopes downward.

- Near-flat — sideways phase.

4. Inputs and assumptions

- Timeframe: 30m.

- History window: 1000 candles per asset.

- Universe: liquid altcoins (stablecoins and illiquid names excluded).

- Price source: unified and consistent across all tickers.

- Update cadence: on each 30-minute candle close.

5. Value ranges

- Sign:

- Positive — on average, alt prices are above their midlines.

- Negative — on average, below their midlines.

- Magnitude: indicates how far the market is, on average, from its “midlines” on 30m.

6. Limitations and caveats

- The indicator is consolidated: it uses the median, so extremes of individual coins are smoothed.

- During structural trend shifts, reversion to “midlines” may lag.

- In broad risk-on/risk-off regimes, the sign bias can persist for extended periods.

#hashtags

Recent Posts

You might be interested

Legal information

Legal status and nature of services. The company does not provide brokerage services, is not a professional participant in the securities market, and does not engage in asset management or investment consulting. The company provides software and technical infrastructure for automating trading based on user settings. The service does not accept or transfer client funds, does not store assets, and has no access to them; integration is carried out via API keys with no withdrawal rights.

Informational nature of materials. All information on the website and in the applications is for informational and educational purposes only and does not constitute individual investment advice, a public offer, or an inducement to trade.

Data and results. Examples of trades, monitoring data, backtesting results, and other information are provided to illustrate algorithm performance and do not constitute a statement or promise of profitability. Past results do not guarantee future performance; variations may occur due to market conditions, slippage, fees, and liquidity limitations.

Risks. Trading in financial instruments and crypto assets involves a high level of risk, including the risk of total capital loss, and may not be suitable for all investors. Before using algorithms on a live account, demo testing and independent risk assessment are strongly recommended.

Jurisdiction. References to Federal Law 'On the Securities Market' No. 39-FZ are provided for reference purposes only. Legal requirements may vary depending on your jurisdiction.