1. What It Is

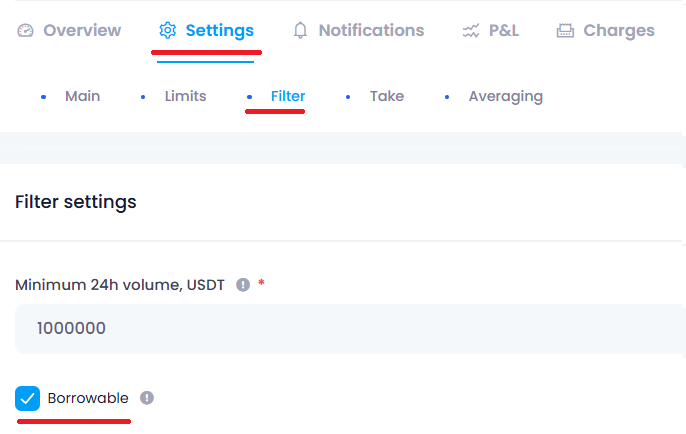

Additional coin selection settings for the spot bot!

- Borrowable is an entry filter: only those spot assets the exchange accepts as collateral in the Unified Trading Account (UTA) are eligible. https://www.bybit.com/user/assets/home/tradingaccount

- Enabled — trade only borrowable coins; disabled — the restriction doesn’t apply.

- Practical effect: you can run spot longs and futures shorts in a single sub-account — purchased coins are counted as collateral.

2. How It Works on the Platform

- Borrowable is applied alongside other filters (liquidity, correlation, White List, etc.).

- The final universe = intersection of conditions: Borrowable ∩ White List ∩ liquidity ∩ correlation …

- Bybit’s borrowable list can change; a coin may drop out of selection — this is expected behavior.

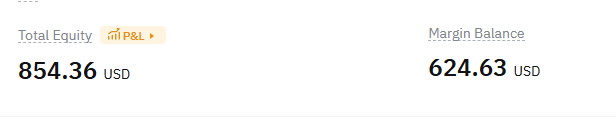

3. How Collateral Is Valued

- Collateral is converted to a USD equivalent with per-asset haircuts (discounts).

- Collateral is not 1:1: e.g., $850 in coins may count as only ~$620 of margin.

- If there are no free USDT, maintenance margin is covered by that collateral amount. Haircuts and eligible lists may change — check Bybit’s current Margin Parameters.

4. Risks

- Liquidation/auto-reduction if collateral price falls: the margin ratio worsens; the exchange may close positions and/or sell part of the collateral.

- Collateral volatility: lower-cap/illiquid coins carry higher risk of sharp value drops.

- Rule changes: a higher haircut or removal from the borrowable list reduces effective margin.

- Cross-margin in UTA: spot, margin, and derivatives draw on the same collateral; a drawdown in one leg impacts the whole account.

- Carrying costs: borrowing interest, funding, and fees.

Conclusion

- Borrowable is a gate filter: only spot assets accepted as UTA collateral are tradable.

- It allows spot longs and futures shorts in one sub-account.

- Collateral is not 1:1 and depends on haircuts; during volatility its value declines.

- If you trade in one sub-account using coins as collateral, properly assess your margin buffer and collateral volatility.

#hashtags

Recent Posts

You might be interested

Legal information

Legal status and nature of services. The company does not provide brokerage services, is not a professional participant in the securities market, and does not engage in asset management or investment consulting. The company provides software and technical infrastructure for automating trading based on user settings. The service does not accept or transfer client funds, does not store assets, and has no access to them; integration is carried out via API keys with no withdrawal rights.

Informational nature of materials. All information on the website and in the applications is for informational and educational purposes only and does not constitute individual investment advice, a public offer, or an inducement to trade.

Data and results. Examples of trades, monitoring data, backtesting results, and other information are provided to illustrate algorithm performance and do not constitute a statement or promise of profitability. Past results do not guarantee future performance; variations may occur due to market conditions, slippage, fees, and liquidity limitations.

Risks. Trading in financial instruments and crypto assets involves a high level of risk, including the risk of total capital loss, and may not be suitable for all investors. Before using algorithms on a live account, demo testing and independent risk assessment are strongly recommended.

Jurisdiction. References to Federal Law 'On the Securities Market' No. 39-FZ are provided for reference purposes only. Legal requirements may vary depending on your jurisdiction.