1. Purpose

The averaging algorithm reduces the average entry price in long (or increases it in short) when the market moves against the position.

It does not trade merely on a price drop/rise: first, the system starts searching for an entry point, and only then executes averaging if a confirmation signal is present.

Correlation with a market "leader" is not used when making the averaging decision.

Examples below refer to long; for short the logic is mirrored.

2. Market phase settings

Long:

- Bull market — allow more frequent/earlier averaging (aggressive).

- Bear market — average less frequently and farther from price (conservative).

Short:

- Bull market — conservative.

- Bear market — aggressive.

All trades, including averaging, require a confirmation on a pullback or in a zone with a high probability of a pullback on the selected timeframe.

3. Logic

Search activation.

Price declines from the average entry by a configured threshold — this only triggers analysis.

Decision.

- Indicators show a high probability the correction is ending → execute averaging.

- Indicators point to continuation against the position → wait.

Averaging size.

- Size multiplier:

new_add_on = current_position × multiplier. - Buy the base asset (spot: coins; futures: contracts), not USDT.

- In long, each subsequent add-on is executed at a lower price than the previous one; in short — at a higher price.

4. Criteria for averaging

The algorithm uses, among others:

- overbought/oversold levels;

- open interest;

- volumes and volume delta;

- average price

- sentiment.

Timeframes:

- Lower TFs — more noise.

- Higher TFs — rarer but stricter signals.

- If there is no signal — the position is held as long as required.

5. Example

A long position on LINEA is open; the take-profit limit was not filled; price is declining.

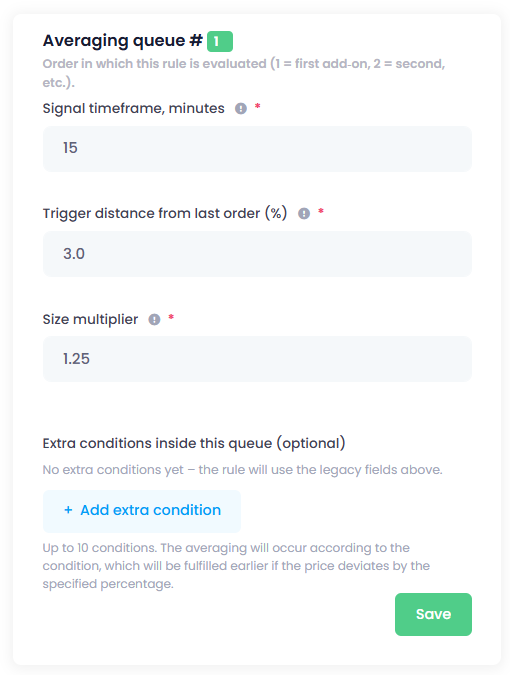

Settings (bull market).

- Activation threshold for search — 3%.

- Timeframe for the first entry point — 15 minutes.

Flow.

- Drawdown exceeded 4% → search for an averaging entry is started.

- Confirmation: oversold zone + buyer strength → add-on executed.

- Take-profit triggered afterwards → trade closed.

6. Extra conditions (cascade)

The cascade is used to avoid waiting for a setup to complete on a higher timeframe when price goes deeper against the position. The deeper the drawdown, the earlier (on a lower TF) the confirmation is searched for — with the unchanged rule that averaging is executed only when a reversal signal is present.

Example: second averaging (long).

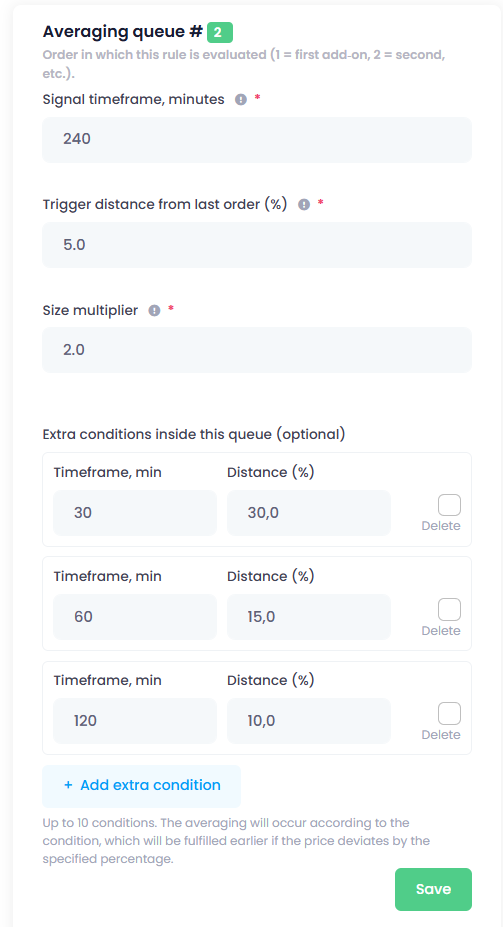

- Base queue settings:

signal TF = 240 minutes (H4),trigger from the last add‑on = 5%. - Price drops ≥ 5% → start searching for an averaging entry on H4.

- Extra conditions inside the queue override the search TF when the drawdown deepens:

- ≥ 10% → search for confirmation on 120 min (H2);

- ≥ 15% → search on 60 min (H1);

- ≥ 30% → search on 30 min (M30).

Cascade rules:

- Upon hitting a threshold, the search switches to the specified lower TF.

- If no confirmation on the selected TF and price goes deeper, the next (even lower) condition becomes active.

- The cascade changes only the confirmation timeframe. All other criteria and sizing rules remain unchanged.

The idea is simple: with a deep drawdown, waiting for an H4 setup can take too long; confirmation is more reasonable to look for on lower TFs where the reversal point forms earlier.

7. Summary

Averaging consists of two steps: trigger → confirmation.

Market‑phase profiles and the cascade provide flexibility without complicating the logic.

If you do not plan to trade in a given phase, leave its parameters unset; the module will activate after the phase changes.

#hashtags

Recent Posts

You might be interested

Legal information

Legal status and nature of services. The company does not provide brokerage services, is not a professional participant in the securities market, and does not engage in asset management or investment consulting. The company provides software and technical infrastructure for automating trading based on user settings. The service does not accept or transfer client funds, does not store assets, and has no access to them; integration is carried out via API keys with no withdrawal rights.

Informational nature of materials. All information on the website and in the applications is for informational and educational purposes only and does not constitute individual investment advice, a public offer, or an inducement to trade.

Data and results. Examples of trades, monitoring data, backtesting results, and other information are provided to illustrate algorithm performance and do not constitute a statement or promise of profitability. Past results do not guarantee future performance; variations may occur due to market conditions, slippage, fees, and liquidity limitations.

Risks. Trading in financial instruments and crypto assets involves a high level of risk, including the risk of total capital loss, and may not be suitable for all investors. Before using algorithms on a live account, demo testing and independent risk assessment are strongly recommended.

Jurisdiction. References to Federal Law 'On the Securities Market' No. 39-FZ are provided for reference purposes only. Legal requirements may vary depending on your jurisdiction.